This is the second in a series of articles about optimizing specific use cases with CockroachDB and Microsoft Azure. Please visit here for the previous installment: Unlocking Scale with CockroachDB and Microsoft Azure, for Retail and eCommerce.

The financial services industry operates in a high-stakes environment where the need for reliability, scalability, and security is paramount. Banks, insurance companies, and fintech firms must process vast volumes of transactions while ensuring data integrity and compliance with stringent regulations. In this article we explore how the combination of CockroachDB and Microsoft Azure provides financial institutions with the tools they need to scale securely and efficiently.

Overview of Financial Services Industry Challenges

Financial institutions face several critical challenges as they manage high transaction volumes and complex compliance requirements:

Transaction Processing and Scalability: Financial services companies must handle millions of transactions daily, especially during peak periods like market close or large-scale trading events. The systems managing these transactions must scale efficiently to ensure there is no disruption in service.

Data Integrity and Compliance: Strict regulatory standards such as GDPR, CCPA, and PCI-DSS require financial institutions to maintain the highest levels of data integrity and transparency. These regulations dictate where data can be stored, how it is processed, and the measures needed to protect it.

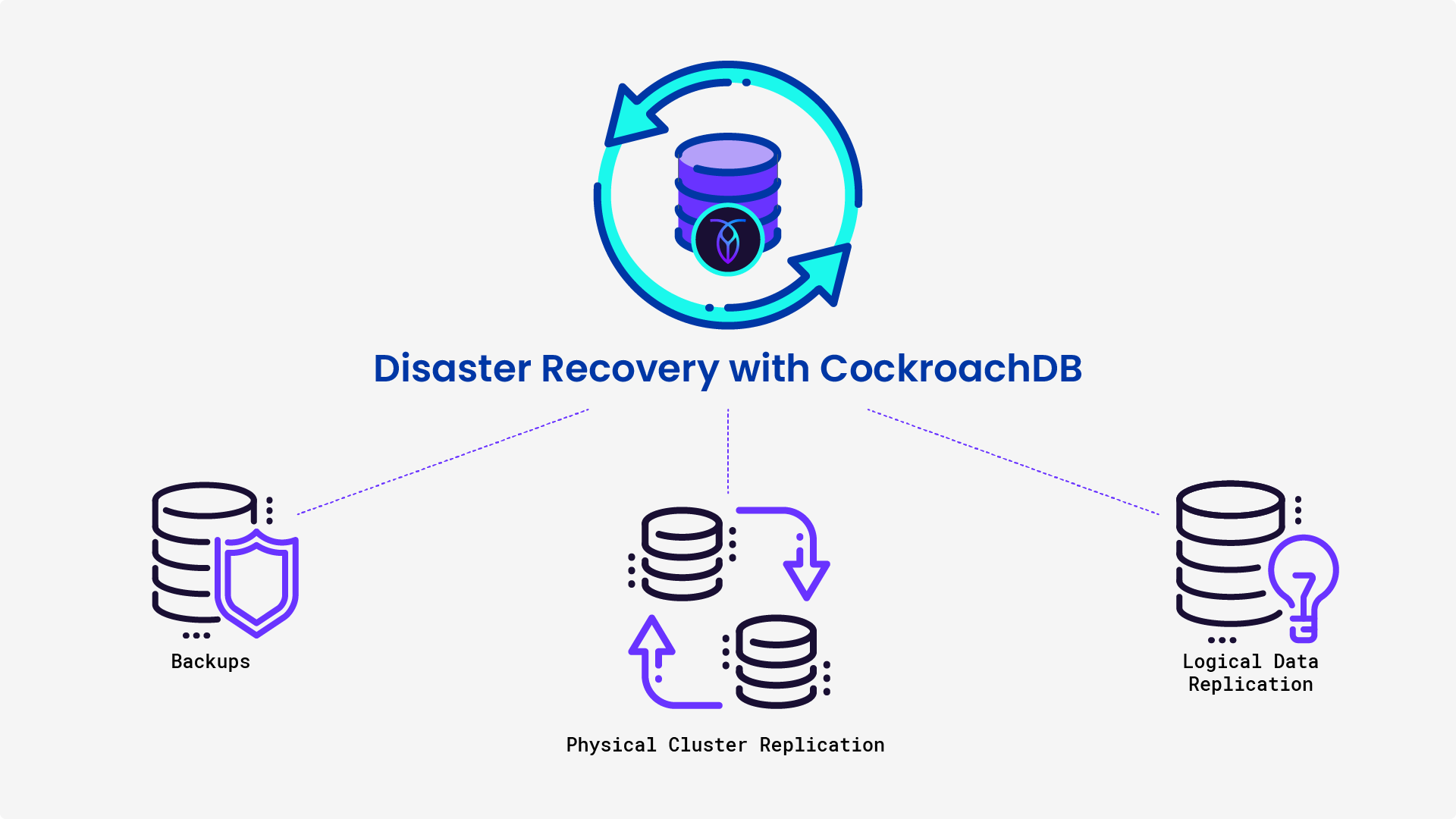

Resilience and Disaster Recovery: The financial sector cannot afford downtime, which can cost it more than $5 million per hour. Systems must be resilient to failures and support disaster recovery strategies to ensure continuous availability, especially for mission-critical financial transactions.

Security: With cyber threats growing in sophistication, protecting sensitive financial data from breaches is a top priority. Financial institutions must maintain the highest security standards to prevent unauthorized access and ensure customer trust.

Business Implications for Financial Services

The challenges faced by financial institutions directly impact business outcomes. Scalability and high availability are essential for maintaining customer trust, processing transactions in real time, and ensuring regulatory compliance. System downtime or data breaches can lead to regulatory fines, reputational damage, and significant financial losses.

By leveraging cloud-native database solutions like CockroachDB on Microsoft Azure, financial services companies can address these challenges while optimizing their infrastructure for long-term growth and security.

Technical Integration of CockroachDB with Azure for Financial Services

CockroachDB integrates seamlessly with Microsoft Azure, providing financial institutions with a robust, scalable, and secure platform. Key integrations include:

Azure VMs: CockroachDB can be deployed on Azure Virtual Machines (VMs), offering scalable compute resources that can dynamically adjust to transaction demands.

Azure Premium Storage: Financial institutions can benefit from low-latency data access, essential for high-speed transaction processing and real-time data insights.

Azure Blob Storage for Backups: CockroachDB’s integration with Azure Blob Storage ensures secure and scalable backup solutions, protecting mission-critical financial data.

Azure Key Management Service (KMS): CockroachDB uses Azure KMS to encrypt backups and meet compliance requirements, ensuring that sensitive financial data remains secure at all times.

Azure Kubernetes Service (AKS): CockroachDB on AKS simplifies the management of distributed clusters, automating tasks such as scaling, failover, and disaster recovery – all essential capabilities for maintaining high availability in financial services.

Azure Synapse via Changefeeds: Financial institutions can stream real-time transaction data into Azure Synapse through CockroachDB changefeeds, enabling instant analytics and fraud detection.

Architectural Integration and Capabilities for Financial Institutions

CockroachDB’s distributed SQL architecture, combined with Azure’s global infrastructure, offers several advantages specifically tailored for financial services:

Distributed SQL for Real-Time Processing: CockroachDB can handle vast transaction volumes across Azure regions, ensuring real-time processing for financial operations, including trading, payment processing, and fraud detection.

Fault Tolerance and Continuous Availability: Financial institutions cannot afford downtime. CockroachDB’s architecture ensures data is replicated across multiple Azure nodes, providing fault tolerance and high availability, even in the event of a regional failure. This ensures that financial transactions continue uninterrupted.

Compliance and Data Sovereignty: CockroachDB’s geo-partitioning capabilities allow financial institutions to store data in specific regions to comply with regulations like GDPR and CCPA. This ensures that sensitive financial data remains within the necessary legal boundaries, while still being globally accessible for real-time operations.

Enhanced Security: CockroachDB’s security features, including data encryption and role-based access control, integrate with Azure’s security services like Azure Key Vault and Security Center. This ensures that financial institutions maintain the highest level of security and meet compliance standards.

Why Financial Services Should Use CockroachDB on Azure

Scalability for Financial Transactions: CockroachDB’s ability to scale seamlessly across Azure regions ensures that financial institutions can handle high transaction volumes without performance degradation, even during market spikes or high trading activity.

Resilience for Mission-Critical Operations: Financial services rely on 24/7 availability. CockroachDB’s distributed architecture ensures continuous availability and automatic failover, preventing downtime that could result in lost transactions, regulatory penalties, or reputational damage.

Compliance with Global Regulations: CockroachDB’s geo-partitioning capabilities, combined with Azure’s global infrastructure, allow financial institutions to comply with data sovereignty regulations while maintaining the speed and efficiency needed for real-time financial operations.

Security at Every Level: CockroachDB integrates with Azure’s security services to provide a multi-layered security model, ensuring that sensitive financial data is encrypted, access is controlled, and compliance standards are met.

Real-Time Analytics for Financial Insights: CockroachDB changefeeds enable financial institutions to stream real-time transaction data into Azure Synapse, facilitating fraud detection, risk management, and real-time decision-making with instant analytics.

Innovation and scale for financial services

The financial services industry demands robust, scalable, and secure database solutions to manage high transaction volumes, comply with complex regulations, and ensure continuous availability. The combination of CockroachDB’s distributed SQL capabilities and Microsoft Azure’s powerful infrastructure offers financial institutions a reliable and scalable platform that meets the sector’s stringent demands. By leveraging this strategic partnership, financial services companies can ensure operational resilience and navigate regulatory compliance, with the ability to scale and innovate in a highly competitive market.

Ready to scale for financial services? Learn everything you can do with CockroachDB and Microsoft Azure: Visit here to speak with an expert.

Harsh Shah is Staff Sales Engineer at Cockroach Labs.